Every merchant ought to get their game right in the highly competitive environment that prevails nowadays. It is very important not only to keep pace with the changing trends in your niche, but also to define them when you can. While most successful merchants make use of point of sale solutions to manage transactions, an equal number of merchants have taken their trade to the internet.

Why Go the Virtual Way?

E-businesses are capable of yielding greater profits than most of their physical shop alternatives. This has helped businesses to expand their markets and improve their marketing efforts. One tool that is at the heart of the successes derived on both fronts is accepting credit card payments. Hence, if you aim to establish yourself as a prominent player in your field, your business needs internet merchant credit card processing.

What is Internet Merchant Credit Card Processing?

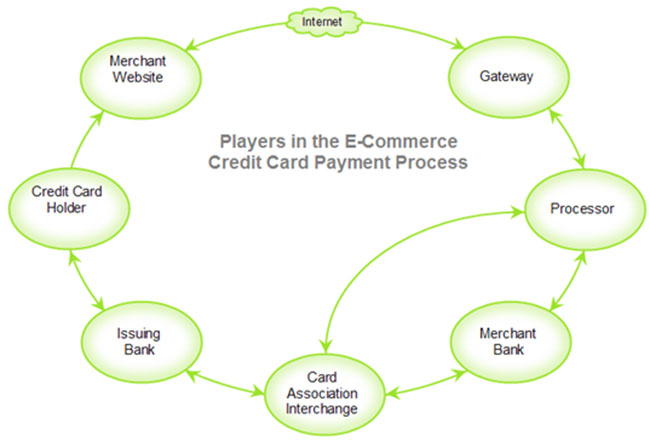

There are certain mechanisms that must be put in place to accept credit card payments over the Web. It is necessary to transmit the sales information from the merchant, obtain authorization for the transaction, get the funds from the bank, and have the funds transferred to the merchant’s primary bank account. In short, the payment needs to be collected from the bank that issued the credit card and deposited into the seller’s bank account.

You need an internet merchant account to accept card payments online, which you can procure from numerous providers in the market. This account has an active communication channel that facilitates the authorization and payment for every transaction. It receives the resultant payment and temporary holds the funds before they are transferred to your preferred account. It is an electronic system that is especially designed for direct sales businesses.

The Basics

Authorization

As a merchant, you have to receive approval for the transaction from the bank that issued the credit card. This is meant to protect you against the use of fraudulent cards and processing transactions for maxed-out cards.

The Process

The process starts with the cashier swiping the customer’s credit card in through the terminal in use. This accesses the information that is contained on the card’s magnetic stripe which is located at the back of the card. The cashier then goes on to input the transaction amount and all this information is transmitted to the card-issuing bank or in some cases, its processor. The information is transmitted through the bankcard association network. After the approval of the transaction the clerk can proceed to print the receipt for the transaction. Some transactions are approved while others may be declined for one of many reasons.

Issues to Consider

When you want to acquire merchant services for your business, it is important to compile a list of options based on what is being widely used on the market, referrals from other merchants and your own research online and other platforms. From this list, you need to find a short list of service providers whose services are in line with your needs and budget.

The services must be:

- Widely used

- Fast and reliable

- In existence for a reasonable amount of time

- Within your budget level

- Able to be implemented on all platforms that you do business on

Merchant services are charged as a percentage of every transaction. It is important to ensure that the service that you select does not eat away your profitability or contain hidden charges. Find a provider that provides a comprehensive solution for internet merchant credit card processing.

A Glimpse into the World of Internet Merchant Credit Card Processing,

Therese

Feb 23. 2016

Thanks for the article!